Understanding AI Application Spending Patterns for Strategic Advantage

If you’re leading an early-stage enterprise software company in 2025, you’re making critical decisions about AI investment every single day. Which tools deliver real ROI? Where should your limited budget go? What are successful startups actually buying versus just talking about?

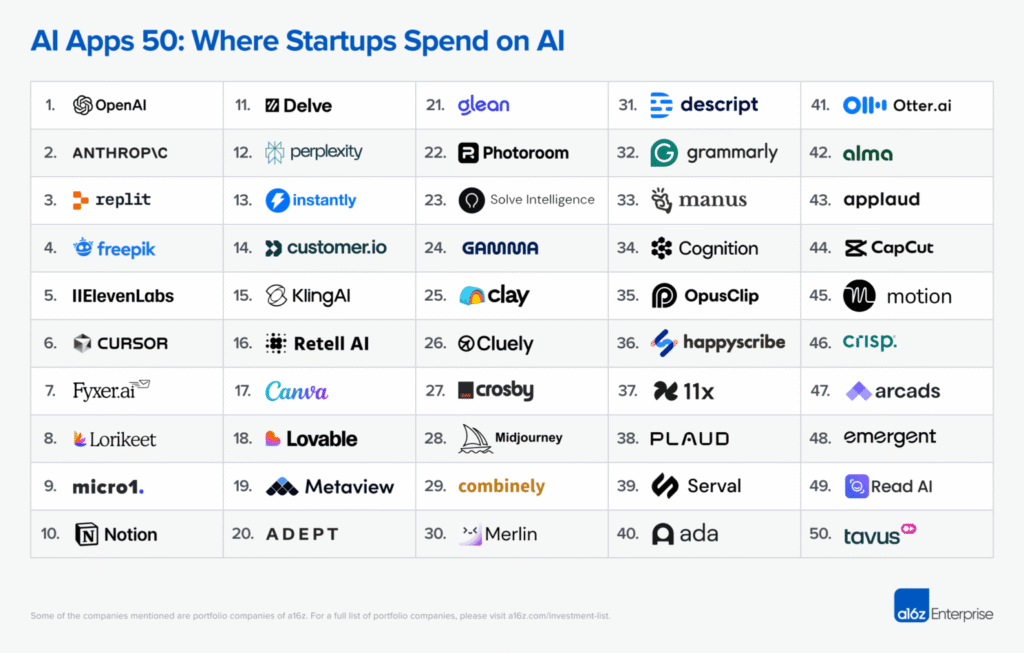

A groundbreaking spending analysis from Andreessen Horowitz, conducted in partnership with Mercury across more than 200,000 startup customers, reveals exactly where AI dollars are flowing in the enterprise. This isn’t based on website traffic or marketing hype—it’s real transaction data from June through August 2025, showing what companies are actually purchasing and deploying.

For CEOs navigating the AI landscape, this data offers a competitive intelligence goldmine. Understanding these spending patterns helps you benchmark your own AI strategy, identify gaps in your technology stack, and spot emerging opportunities before they become obvious to everyone else.

The Horizontal vs Vertical AI Spending Split: What It Means for Your Strategy

https://a16z.com/the-ai-application-spending-report-where-startup-dollars-really-go

The data reveals a clear 60-40 split: 60% of AI application spending goes to horizontal tools that boost productivity across entire companies, while 40% targets vertical solutions for specific roles or functions. This distribution challenges the common assumption that specialized, role-specific AI dominates enterprise budgets.

What does this mean for your business? If you’re building or buying AI solutions, the market is signaling that broad applicability matters more than deep specialization—at least for now. Companies want tools that can scale across teams, not just optimize a single department.

The top horizontal platforms dominating spend include OpenAI at number one, Anthropic at number two, and Replit—an agentic product development tool—at number three. The presence of Replit in the top three is particularly telling. This isn’t just about accessing language models; companies are investing heavily in tools that let them build AI-native applications themselves.

Other significant horizontal players include Notion (number 10), which embeds AI within familiar workspace environments, and Perplexity (number 12), demonstrating that the general assistant space remains far from a winner-takes-all scenario. Your employees likely need multiple AI interfaces depending on their context and task, which explains why various platforms continue capturing budget share.

Meeting Support and Productivity Tools: The Unexpected Budget Priority

One category commanding surprising spending levels is meeting support—primarily AI notetakers and real-time feedback tools. Products like Fyxer (number 7), Otter AI (number 41), and Read AI (number 49) rank prominently in enterprise spend, while newer entrants like Cluely (number 26) offer in-meeting coaching and feedback.

Why should this matter to you as a CEO? Because your competitors are systematically eliminating meeting friction and capturing institutional knowledge that would otherwise be lost. Every meeting becomes documented, searchable, and actionable. If you’re not deploying similar capabilities, you’re leaving productivity gains—and competitive intelligence—on the table.

The practical implication: evaluate your meeting culture and knowledge capture systems. Are insights from customer calls, strategy sessions, and team meetings being systematically recorded and made accessible? If not, you’re likely hemorrhaging valuable information that could inform better decisions.

Creative Tools and Vibe Coding: From Specialist Functions to Universal Skills

Perhaps the most transformative finding is that creative tools and development platforms—traditionally confined to marketing, design, and engineering teams—are now becoming horizontal capabilities used across entire organizations.

Creative tools represent the largest single category in the rankings, with ten companies making the list. Freepik leads at number four, followed by ElevenLabs (text-to-speech) at number five. Image and video tools like Canva, Photoroom, Midjourney, Descript, Opus Clip, and Capcut all rank prominently. Even avatar generation platforms like Arcads (number 47) and Tavus (number 50) are seeing significant enterprise adoption.

The strategic insight here is profound: AI is democratizing capabilities that were once specialist domains. Your sales team can now create professional graphics. Your operations team can produce explanatory videos. Your customer success team can generate personalized voice messages at scale.

Similarly, vibe coding platforms—tools that let anyone build applications through natural language—are reshaping who can contribute to your technical infrastructure. Four companies made the list: Replit, Cursor, Lovable, and Emergent. Replit alone generated approximately 15 times more revenue than Lovable from the Mercury customer base, suggesting that enterprise teams favor platforms offering deeper functionality beyond simple UI generation.

For early-stage CEOs, this democratization creates both opportunity and obligation. The opportunity: dramatically expand the capabilities of every team member without proportionally expanding headcount. The obligation: rethink your organizational structure and skill requirements, because the old boundaries between technical and non-technical roles are dissolving.

Vertical AI: Supercharging Humans vs Replacing Them

Among the 17 vertical application companies in the rankings, 12 focus on augmenting human employees, while only five position themselves as autonomous “AI employees” capable of handling workflows end-to-end.

The five agentic solutions include Crosby Legal (agentic law firm, number 27), Cognition (AI engineer, number 34), 11x (automated go-to-market employees, number 37), Serval (AI IT service desk, number 39), and Alma (AI-powered immigration law, number 42).

The current 12-to-5 ratio favoring human augmentation over replacement suggests the market isn’t ready—or willing—to fully automate core functions just yet. However, the report anticipates this balance shifting, particularly in professional services where startups aren’t locked into expensive multi-year contracts with traditional providers.

Your strategic takeaway: carefully evaluate which functions to augment versus replace. For now, most successful companies are using AI to eliminate repetitive tasks while keeping humans in the loop for judgment calls and relationship management. The companies that will pull ahead are those that thoughtfully combine AI capability with human expertise, not those that pursue automation for its own sake.

The Product-Led Growth Revolution: Consumer-to-Enterprise in Months, Not Years

Nearly 70% of companies on the spending list can be adopted by individual employees and brought into teams without requiring enterprise licenses upfront. Twelve companies appeared on both the enterprise spending list and a16z’s Consumer Top 100, indicating they successfully span both markets.

This represents a fundamental shift in software adoption patterns. AI tools are powerful enough to serve enterprise needs while remaining accessible enough for individual adoption. The urgency around AI adoption means these tools get “pulled” into enterprises faster than any previous software category.

Companies like OpenAI reportedly earned 75% of revenue from consumers as of October 2024, with recent estimates closer to a 50-50 consumer-enterprise split. Midjourney and Cluely continue generating consumer-majority revenue while building enterprise presence.

For early-stage enterprise CEOs, this pattern offers a critical strategic lesson: product-led growth and enterprise sales are no longer sequential phases. You can—and perhaps should—pursue both simultaneously. The products winning budget share make it easy for individual contributors to start using them, then expand organically within organizations.

This also means your employees are already using AI tools, whether you’ve formally approved them or not. The question isn’t whether to adopt AI applications, but how to thoughtfully integrate the tools already being used while establishing governance around data security and spending.

What Successful Startups Are Actually Buying: Category Breakdown

The spending data reveals clear category priorities:

General LLM Access: OpenAI, Anthropic, and Perplexity capture the largest share, with companies hedging bets across multiple providers rather than committing to a single platform.

Development Tools: Replit’s number three ranking—ahead of creative tools and vertical solutions—signals that building custom AI applications is a top priority, not just consuming pre-built solutions.

Creative Capabilities: With ten creative tools in the top 50, from text-to-speech to video generation, companies are systematically eliminating creative bottlenecks.

Meeting Support: AI notetaking and feedback tools represent consistent spending, indicating meeting efficiency and knowledge capture are universal pain points.

Vertical Solutions: Customer service, legal, compliance, sales, and marketing tools serve specific functions but command smaller individual budget shares than horizontal platforms.

Making Smarter AI Spending Decisions: Practical Recommendations

Based on this spending intelligence, early-stage enterprise software CEOs should consider:

Start with horizontal foundations: Ensure your team has access to general AI assistants and development platforms before investing heavily in specialized vertical tools. The data shows this is where companies achieve the broadest impact.

Democratize creative and technical capabilities: Deploy tools that let non-specialists create professional content and build simple applications. This force-multiplies your team’s output without proportional headcount increases.

Capture institutional knowledge: Implement meeting intelligence tools that document, organize, and make accessible the insights generated in conversations. This capability pays compounding dividends as your organization scales.

Embrace product-led growth: If you’re building AI-enabled software, make it easy for individuals to adopt and bring into their organizations. The fastest-growing AI companies blur the line between consumer and enterprise from day one.

Stay model-agnostic: Companies are hedging across multiple LLM providers. Build your applications to work with various models, and give teams access to multiple platforms rather than standardizing too early.

Test agentic solutions selectively: While most vertical AI still augments humans, experiment with fully autonomous solutions for well-defined workflows, particularly in professional services where traditional providers are expensive.

The Competitive Implications of AI Spending Patterns

The companies ranking highest in this spending analysis aren’t just buying tools—they’re systematically building organizational capabilities that create sustainable competitive advantages. Every dollar spent on the right AI application should translate into faster execution, better decisions, or higher quality outputs.

Your competitors are already making these investments. The question is whether you’re matching them, or better yet, finding overlooked opportunities in the spending data.

The shift toward horizontal AI tools means capabilities are becoming more evenly distributed across companies. The differentiation increasingly comes from how effectively you integrate these tools into workflows, train teams to use them, and build on top of them rather than from having exclusive access.

For early-stage enterprise software CEOs, this spending report offers more than benchmarking data. It’s a roadmap to the capabilities your organization needs to remain competitive, the categories where innovation is happening fastest, and the strategic bets successful startups are making with limited resources.

The AI application landscape will continue evolving rapidly, but these spending patterns reveal where real value is being created today—not in hypothetical futures, but in the daily transactions of 200,000 startups navigating the same challenges you face.

Your next budget cycle should reflect these insights. The startups that allocate resources toward horizontal AI platforms, democratized creative and development tools, and knowledge capture systems are building compounding advantages that will be difficult to overcome later.

The data is clear. The question is what you’ll do with it.

Frequently Asked Questions

What is the 2025 AI Spending Report?

The 2025 AI Spending Report, published by Andreessen Horowitz and Mercury, analyzes transaction data from over 200,000 startups to reveal how real companies allocate their AI budgets — not based on hype or marketing, but actual purchases and usage patterns.

Which AI platforms dominate enterprise budgets?

The top spending destinations include OpenAI, Anthropic, and Replit, followed by tools like Notion and Perplexity. This highlights a preference for horizontal AI platforms that enhance productivity across entire organizations rather than niche, role-specific tools.

Why do meeting intelligence tools appear in the top spending categories?

AI-powered meeting assistants like Fyxer, Otter AI, and Read AI help companies capture, organize, and search meeting insights — preventing knowledge loss and improving decision-making efficiency across teams.

What are the biggest takeaways for early-stage enterprise CEOs?

Focus on horizontal foundations first, democratize creative and technical capabilities, capture institutional knowledge, and embrace product-led growth. These patterns are driving competitive advantage among fast-growing startups in 2025.

How can this data guide smarter AI investment?

Use the spending trends as benchmarks. Invest where the most successful startups are seeing ROI — in general AI platforms, creative tools, and AI-enabled development systems that scale across functions.