The software market is ever changing. The market evolution from mainframes to mini computers to PCs to generic Linux servers to cloud services (AWS, google Cloud, etc.), has driven the evolution in software technology. As Aldous Huxley noted “That men do not learn very much from the lessons of history is the most important of all the lessons that history has to teach.” 50 year old software products can teach modern SaaS companies about longevity.

The Story of Mark IV. Introduced in 1968 and Still Going Today

Mark IV was one of the first fourth generation languages introduced in 1968 by Informatics General. It ran on IBM 360/370 mainframes. Mark IV combined a simple programming language with extensive data access tohelpcompanies launch new applications quickly. Its main benefit was allowing faster application development on the order of 6 to 10 times faster than doing a system using a 3GL, such as COBOL. When IBM unbundled software from its hardware business in 1969, Mark IV took off. It became the first independent software package to produce over $10 million of revenue in a year. Informatics was acquired by Sterling Software in 1985 (the first hostile takeover in the software industry.) Sterling was subsequently acquired by CA in 2000. Broadcom acquired CA in 2018. Mark IV (subsequently rebranded as CA VISION:Builder) still lives on today – 53 years after it was launched.

When Sterling acquired Mark IV it was placed in the Information Management Division (IMD) headed by Carole Morton. In 1997I was a senior executive with Sterling’s Application Management Group that IMD was a part of. Carole Morton was a legend at Sterling. IMD had a portfolio of laggard products like Mark IV. Yet Carole was able to meet or exceed IMD’s annual financial plan for 19 consecutive quarters. That involved year over year and quarter over quarter increases in revenue, operating profit, and EPS contribution. Early in my tenure as a senior executive I asked Carole at a quarterly review meeting “You have a portfolio of products that are anywhere from 10 to 30 years old. How do you beat your plan every quarter and year?” The lessons she taught me have stuck with me ever since and have been key to my success.

Six Principles of Laggard Product Management That Are Relevant to Modern SaaS Companies

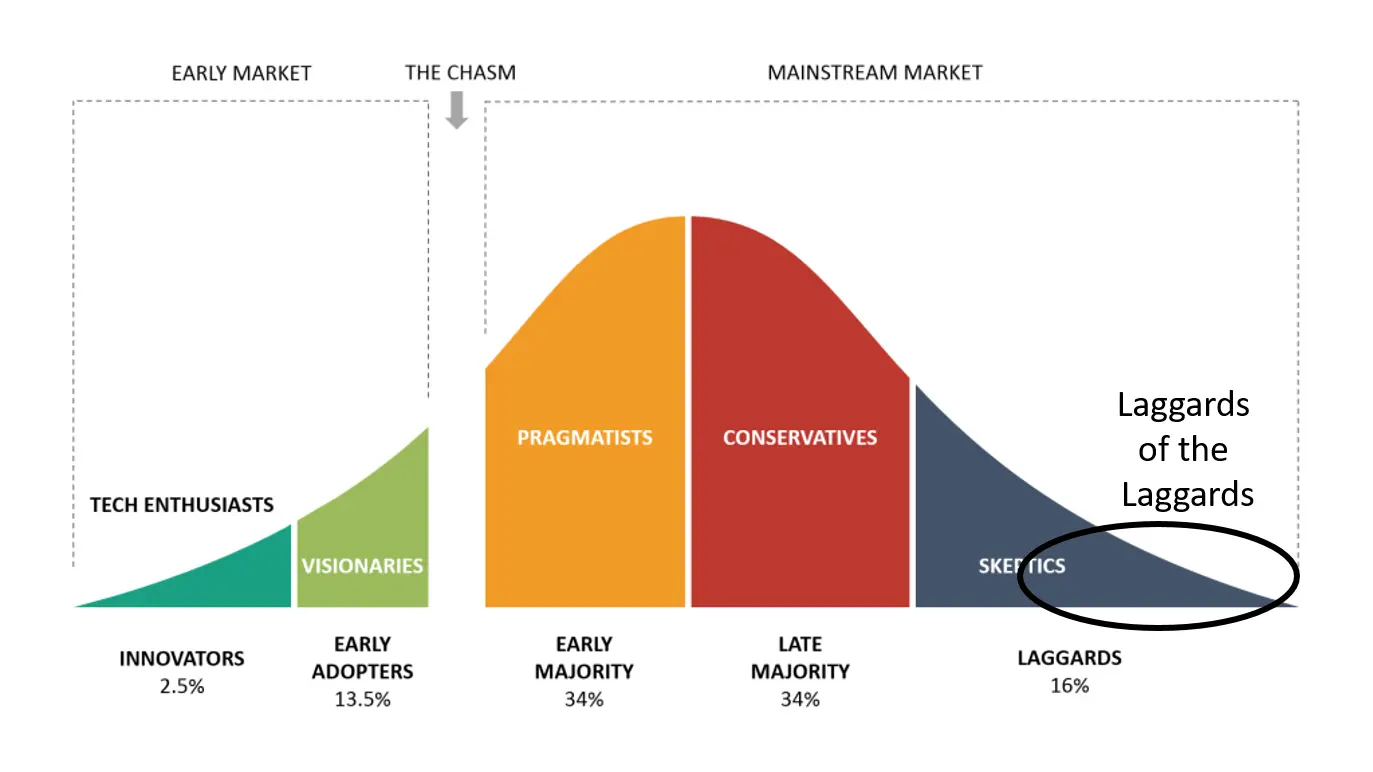

There are many approaches to maximizing the performance of products in the laggard stage of the technology adoption life cycle. Carole Morton taught me a lot of things and I picked up a few more along the way. Many of these principles apply to today’s contemporary SaaS applications. These principles include:

1. Environmental Currency

Staying current with releases of operating systems, TP monitors, DBMS, security systems, etc. was critical to Mark IV’s success. Mark IV is a licensed software on-premise solution. In today’s SaaS world software vendors are generally exempt from having to worry about staying current with a customer’s software environment, except in the case of integrations with customer on-premise applications.

Mark IV was originally designed to run on IBM 360 mainframes running DOS/360. Over the years, Mark IV was upgraded to support the IBM 370, 390, and zSeries mainframes. It supported all of the major IBM mainframe operating systems from DOS/360 to MVS and today’s zOS. It supported a variety of TP monitors from CICS to IMS/DC as well as today’s TCPIP. It supported data access to VSAM files and major databases management systems like IMS, IDMS, and Db2.

From a SaaS perspective, environmental currency is more of an internal concern. Keeping your application up to date is important – especially from a SOC 2/3 perspective. From a customer perspective, staying current with their on-premise software your application integrates with is critical. For example, many SaaS applications integrate with customers SAP systems. If customers upgrade to S/4HANA (current supported release for SAP, there are changes to the iDOC format which is commonly used as an integration point for SaaS applications. Maintaining currency with relevant customer on-premise software is critical for SaaS revenue retention and expansion.

2. Mission Critical Systems

Mission critical systems is one of the core reasons why Mark IV has survived for half a decade. Mark was used to quickly create thousands of mission critical systems in the 1970s and 1980s. It was one of the most popular mainframe reporting tools. It was also used to create sophisticated financial management, supply chain, and government applications. As long as Mark IV stayed current with the evolution of mainframe hardware and software technology, there was little reason to replace it. As Bert Lance, the Director of the Office of Management and Budget during Jimmy Carter’s Presidency, noted “If it ain’t broke, don’t fix it.”

Replacing Mark IV applications is like replacing COBOL applications. COBOL was first introduced in 1959. 62 years later it is still going strong. As Reuters noted:

Some companies are making efforts to replace COBOL code that is already in use. This is no simple migration though. It can take years to replace a program that relies on COBOL. It is a time-consuming and costly task that demands expert programmers with the ability to navigate older mainframes and slowly update commands. A 2017 Reuters article reports that “When Commonwealth Bank of Australia replaced its core COBOL platform in 2012, it took five years—and cost $749.9 million.” Replacing legacy Mark IV applications is even more complex due to the low number of competent Mark IV developers available in 2021.

Modern SaaS companies can increase their revenue retention and customer lifetime value (CLTV) by associating their products with a customer mission critical function like accounting, supply chain management, or regulatory reporting. Even if your SaaS application does not automate one of these key functions you can still tie your SaaS app to mission critical application through deep integrations. Once those integrations are in place, it is hard to replace or supplicate them. Your SaaS app can become as permanent as COBOL and Mark IV are.

3. Excellent Customer Service

A customer may talk to a sales person five or ten times during a sales cycle. Over their lifetime with your company they could interact with customer service hundreds, if not thousands of times. Carole Morton at Sterling’s IMD always invested in customer service. They offered both phone and email support. Customers built up long term relationships with customer service reps who were invested in their success.

Experience has shown that SaaS companies with outstanding customer support have lower revenue churn and gain valuable new customers through referrals. Some recent stats demonstrate the value of excellent customer support for SaaS companies:

- An NPS Promoter score has a customer lifetime value that’s 600%-1,400% higher than a Detractor. Bain & Co

- 90% of consumers worldwide consider issue resolution as their most crucial customer service concern. (KPMG)

- 80% of customers say the experience a company provides is just as necessary as its products or services. (Salesforce)

- 63% of consumers expect businesses to know their unique needs and expectations, while 76% of B2B buyers expect the same thing. (Salesforce Research)

- 67% of customers report a terrible customer experience as the reason for switching businesses. (Esteban Kolsky)

- A study has shown that more than 76% of all consumers prefer the traditional medium of phone calls to reach customer support representatives. (CFI Group)

- More than 50% of customers across all age groups typically use the phone to reach out to a service team, making it the most-used channel for customer service. (Zendesk)

- 75% of consumers will still choose to interact with a real person even as the technology for automated solutions improves. (PwC)

- A whopping 95% of consumers say that customer service is essential for brand loyalty, and 60% of consumers report having deserted a brand and switching to a rival company because of poor customer service. (Microsoft Dynamics 365)

4. A Little Feature Factory is Not a Bad Thing

The ProductPlan blog noted “In product management lingo, feature factory is typically a derogatory term.” Yet Mark IV had at least two new features in each of its releases. Generally they were not major items, but they tended to be focused on specific customer requests. Customer felt valued and appreciated when their ideas were incorporated into the product.

Not every release of Mark IV contained customer requested features. Sometimes the focus was on supporting a new operating system or database like Db2. Other times it involved supporting a new technology like HTML. The key point Carole Morton made was that you had to add new value to the produce every year to help justify paying annual maintenance fees.

From a SaaS vendor perspective the same concept applies. You need to add value to your core product as one of the ways customers can justify paying increased subscription fees.

5. Price Increases

Sterling Software was not the first company to introduce annual price increases, but they certainly knew how to optimize recurring revenue using price increases. Annual software maintenance fees were the bulk of Sterling’s recurring revenue. Maintenance fees were calculated as a percentage of the then current software license fees. By raising license fees every year Sterling got an automatic lift in maintenance fees. This help offset the inevitable customer churn do to things like mergers, bankruptcies, or major technological shifts like eliminating mainframes. Sterling had sixteen product divisions that used this strategy. The most successful divisions, like IMD, found that there were critical success factors for this strategy. First, keep the increase below the current rate of inflation. Here is a chart of inflation rates from 1990 to 2020:

This limited Sterling’s price flexibility, but it significantly helped to explain the price increase to customers.

The second critical success factor for Mark IV was environmental currency. Staying up to date with operating system, database, TP monitor, and security infrastructure was critical. As customers upgraded their infrastructure, Mark IV had to stay current or risk being discontinued. The third critical success factor was always deliver new customer product value in each release. While the features might be small, they demonstrate that the vendor is continuing to invest in the product.

From a SaaS company perspective, there are a couple of key takeaways. First, get customers used to annual price increases. Things like labor costs and utilities increase every year. As long as you keep your increases below the prevailing inflation rate, you can explain it to customers. Their organizations are probably facing the same inflationary challenges you do. Environmental currency is not a major issue for SaaS customers. Staying current with changes to customer integration points is important. Finally, before any price increase make sure you have added additional customer focused value into your base product. It can help your account managers answer the inevitable question “Ao what have you done for me lately”

6. Initiative Tying

The most effective technique IMD used to retain revenue was initiative tying. Every year they would identify three key initiatives their customers faced and they determined how their products could be used to support those initiatives. In 1999 he three they chose were eBusiness, data warehousing, and Y2K compliance. Sales reps and pre-sales experts were trained in each of these initiatives so they could act as trusted advisors for their clients. It gave them something new to talk about – which is very important for a customer you have been dealing with for over a decade. Some salespeople went as far as to removing the word sales from their title and business cards and replace it with consultant.

The same strategy can be applied by today’s contemporary SaaS companies. Consider the following nine trends for 2021:

- Artificial Intelligence (AI) and Machine Learning

- Robotic Process Automation (RPA)

- Edge Computing

- Quantum Computing

- Virtual Reality and Augmented Reality

- Blockchain

- Internet of Things (IoT)

- 5G

- Cyber Security

The more you can tie your SaaS solution to trends like this, the easier it will be to retain and grow revenue from your customers.

What 50 Year Old Software Products Can Teach Modern SaaS Companies About Longevity

Today’s modern SaaS companies face significant challenges in growing their revenues, profits, and enterprise value. Fortunately, they have the benefit of learning lessons from products, like Mark IV, that have been around for decades. Strategies like Initiative Tying, Price Increases, Mission Critical System Integration, and even a little Feature Factory have proven successful for decades. As Indira Gandhi noted “History is the best teacher, who has the worst students.” Today’s SaaS companies should learn from the hard earned success of past software giants.

Also published on Medium.