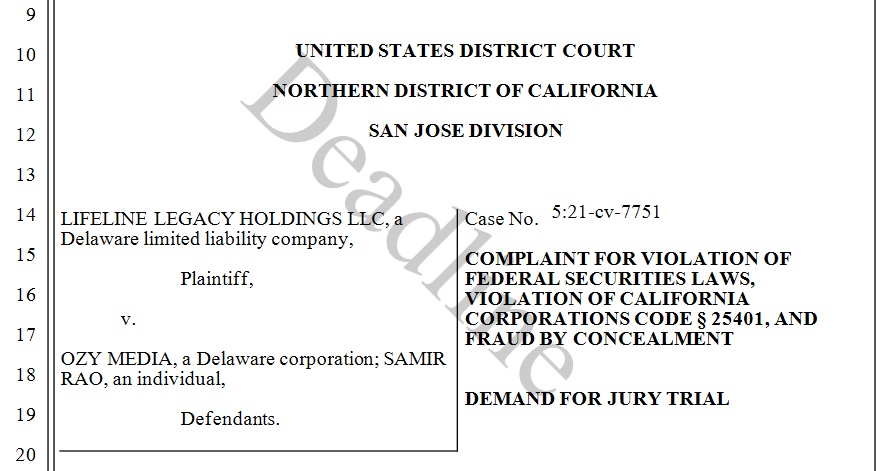

The first investor lawsuit in response to the crisis at Oxy Media has been filed. On Monday LifeLine Legacy Holdings of Beverly Hills, Calif., which put more than $2 million into the Oxy’s Series C fundraise, filed suit in the San Jose Division of the U.S. Northern District Federal Court. The suit entitled “COMPLAINT FOR VIOLATION OF FEDERAL SECURITIES LAWS, VIOLATION OF CALIFORNIA CORPORATIONS CODE § 25401, AND FRAUD BY CONCEALMENT was filed against Ozy Media and its COO Samir Rao. You can read the entire complaint here. How a Failed Zoom Due Diligence Call Led to a Disaster for a Firm That Had Raised Over $70 million in VC Funds provides an entire background of the Ozy crisis

The Backstory

The crisis began on Sunday, September 26th, Ben Smith from the New York Times published an article entitled “Goldman Sachs, Ozy Media and a $40 Million Conference Call Gone Wrong”. The subtitle was “The digital media company has raised eyebrows for its claims about its audience size for years. Then came the strange voice on the phone.” What followed was a bizarre tale of how the COO of Ozy Media started a Zoom due diligence call with Goldman Sachs, then switched to a conference call. On that call, Samir Rao, the co-founder, and chief operating officer of Ozy, used a voice changer and impersonated Alex Piper, the head of unscripted programming for YouTube Originals. After the call, Goldman figured out what had happened and the proverbial shit hit the fan.

Stories about Ozy Media’s shady business practices erupted. The chairman of Ozy’s board, Mark Lasry, CEO of Avenue Capital Group who led Ozy’s Series C $35 million round, resigned. A key reporter who had recently joined from the BBC resigned. Famed angel investor Ron Conway, who had invested in an earlier round, returned his shares and broke all ties with Ozy. Carlos Watson, Ozy’s CEO, resigned from his board seat at NPR. On Friday, October 1, Carlos Watson informed employees that the board had voted to shut down the company. On Monday, October 4, Carlos Watson announced on The Today Show “We are going to open for business,” Watson said in an appearance on NBC News’ “Today” show. “This is our Lazarus moment if you will.”. Also on Monday LifeLine Legacy Holdings filed its lawsuit.

The Lawsuit

The suit was filed in the San Jose Division of the U.S. Northern District Federal Court. It was the first of what can be expected to be one of many. The suit names Ozy Media and Samir Rao as defendants. You can read the full complaint here. The complaint makes three major charges:

- Fraud in Connection with the Purchase or Sale of Securities Violations of Section 10(b) of the Exchange Act and Rule 10b-5

- Fraud in the Sale of Securities Violation of California Corporations Code § 25401

- Fraud by Concealment

As noted by Deadline’s Jill Goldsmith in Embattled Ozy Media Hit With First Investor Lawsuit Over Faked Fundraising Call

“Watson, who says he was not on on the call, attributed the event to mental health issues of his fellow executive, but the purpose of the impersonation may have been to assure potential investor Goldman that Ozy-produced videos were successful on the giant video sharing platform.

“In 2021, based upon direct assurances concerning Ozy Media’s strong business performance, investments by high profile institutional investors, high viewer metrics, and competent and honest company management, LifeLine agreed to invest in Ozy Media. At the time that LifeLine’s investments were solicited and made, Ozy Media and, more specifically, Samir Rao knew that, in fact, the representations made to LifeLine regarding Ozy Media were untrue and that Rao had fail to disclose material information about Ozy Media to LifeLine,” the suit says.

“More particularly, Ozy Media knew, but failed to disclose to LifeLine that on February 2, 2021 the company, through Samir Rao, engaged in fraudulent, deceptive and illegal conduct when Mr. Rao, while participating in a call with a potential high profile institutional investor, impersonated an executive of YouTube and misrepresented viewership of Ozy Media programming shown on YouTube. Ozy Media also failed to disclose that said high profile institutional investor refused to invest in Ozy Media after learning of said fraudulent conduct and that the company, as a result, was under investigation by various government agencies.”

“In 2021, based upon direct assurances concerning Ozy Media’s strong business performance, investments by high profile institutional investors, high viewer metrics, and competent and honest company management, LifeLine agreed to invest in Ozy Media. At the time that LifeLine’s investments were solicited and made, Ozy Media and, more specifically, Samir Rao knew that, in fact, the representations made to LifeLine regarding Ozy Media were untrue and that Rao had fail to disclose material information about Ozy Media to LifeLine,” the suit says.

“More particularly, Ozy Media knew, but failed to disclose to LifeLine that on February 2, 2021 the company, through Samir Rao, engaged in fraudulent, deceptive and illegal conduct when Mr. Rao, while participating in a call with a potential high profile institutional investor, impersonated an executive of YouTube and misrepresented viewership of Ozy Media programming shown on YouTube. Ozy Media also failed to disclose that said high profile institutional investor refused to invest in Ozy Media after learning of said fraudulent conduct and that the company, as a result, was under investigation by various government agencies.”

The Other Shoe Has to Drop

The entire Ozy crisis has been fascinating. Every day something new pops up. When you go back and look at the genesis of th story it’s hard to believe that Carlos Watson is not fully involved in the scandal. Samir Rao, Ozy’s COO, and Carlos Watson have worked together since the early 2000s when they both worked at Goldman Sachs. It strains credulity that Carlos was not aware of the stunt that Samir was going to pull by feigning inability to join the Zoom call, launching a teleconference, and using a voice disguiser to impersonate Alex Piper from Youtube.

Carlos and Samir had raised over $70 million from VC investors in three round of financing. Again it is hard to believe that Carlos was not fully aware of what Samir was going to pull on their mutual former employer. The news of this week has demonstrated that Carlos Watson frequently used exaggerations and known deceptions in his dealings with his employees, vendors, and investors. It is only a matter of time before the proverbial other shoe drops and the story shifts to what did Carlos know and when did he know it.

Summary

The LifeLine Legacy Holdings federal lawsuit is the first of what will certainly be many lawsuits against Ozy Media and its executives. Every day that passes another new scandal is revealed. What will tomorrow bring?

Also published on Medium.