The battles between marketing and sales executives in software companies are legendary. “I need more leads!” and “Why don’t you close the leads you have” echo in boardrooms across the land. And it’s not just leads. Sales and marketing executives frequently disagree on a range of topics from CRM data hygiene. lead scoring, the need for events, faster follow up on leads, better account executive prospecting, competitive feature parity, pricing and discounting, the list goes on and on. Why do marketing and sales seem to be misaligned? There are several answers, but surprisingly the root cause may lie in the average tenures of senior marketing and sales leaders.

Chief Marketing Officer and Chief Revenue Officer Tenures

The average tenures of CMOs and CROs are surprisingly short – about 8 to 10 quarters.

Chief Revenue Officer Tenures

The Bridge Group reported that the average CRO tenure is under two years – barely 8 quarters.

They surveyed 406 B2B companies:

Chief Marketing Officer Tenures

According to a study conducted by recruiting firm Spencer Stuart, the average CMO tenure is 40 months – about 10 quarters. The median tenure was only 25 months – a little more than 6 quarters:

Some segments of the technology market have even shorter tenures.

Sales & Marketing Are Rarely in Synch – Because Their Leaders Are Hired at Different Times

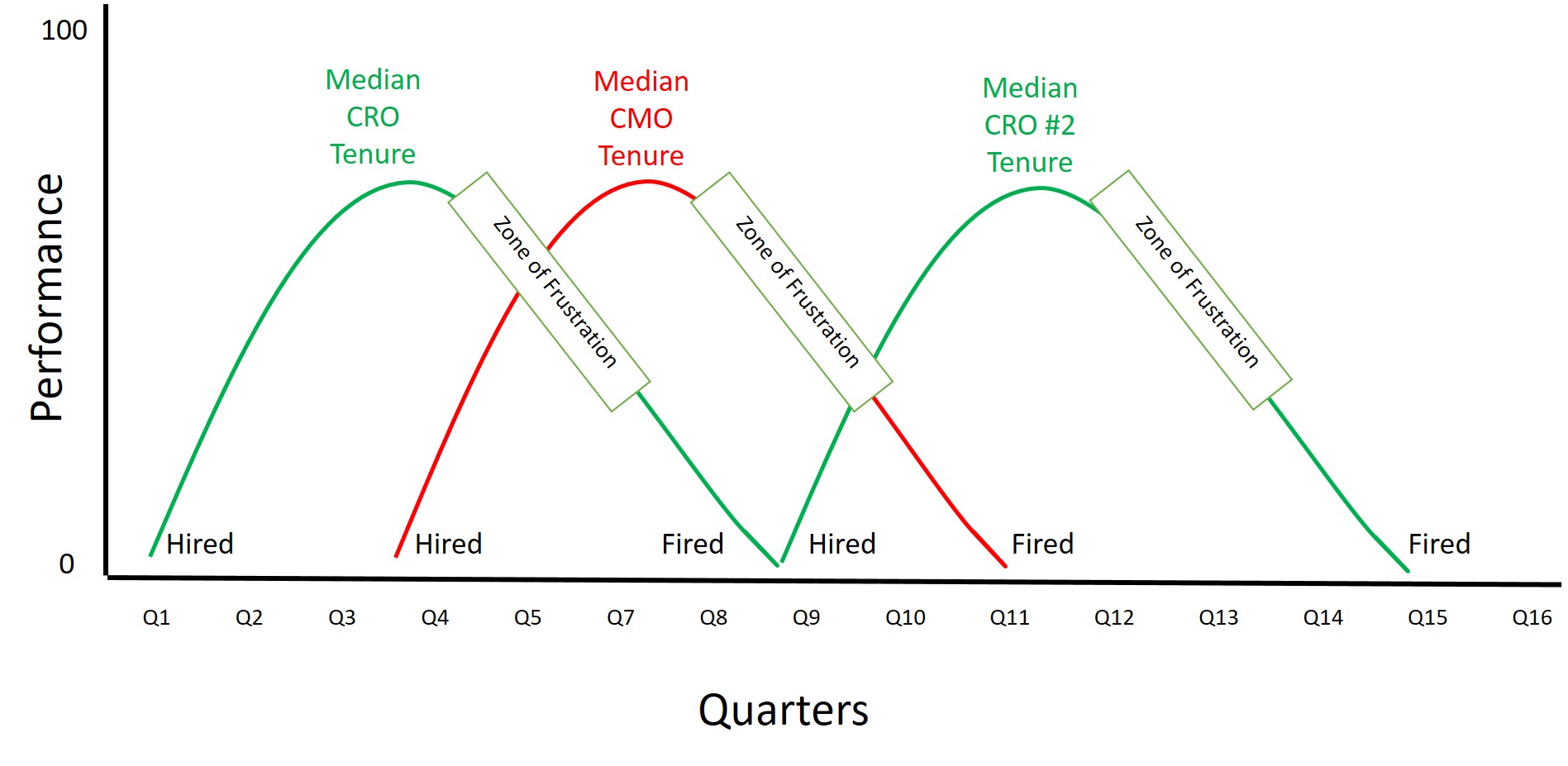

A core reason why sales and marketing are usually misaligned is that their leaders are hired at different times. Startups often hire a sales executive before a marketing executive. Given the relatively short tenures, it is reasonable to assume that an executive’s performance rises then declines. Where each executive is in their personal performance cycle is probably the main driver behind sales and marketing misalignment.

At Any Point in Time Marketing & Sales Misalignment is Real

Freshworks, who just IPOed for over $10 Billion, recently published The State of Sales and Marketing Alignment in 2021. They surveyed over 1,200 business leaders:

What Sales Wanted from Marketing

Visibility into upper funnel activities and leads were the number one concern of sales regarding marketing:

What they were not interested in was:

What Marketing Wanted From Sales

More visibility into the lower end of the funnel activities and consistent usage of CRM and CRM data hygiene was Marketing’s top interests:

How to Align Marketing & Sales

The conflict between Marketing and Sales is inevitable. Given the short tenure of senior marketing and sales leaders, there are almost always going to be frustrations. As one executive’s success is rising, their counterpart is going to be declining. While there are many small ways that marketing and sales can tactically align, the biggest way to align is to focus on leads.

SaaS Demand Generation is Tough

As pointed out in The Ugly Truth of B2B SaaS Customer Acquisition Costs most SaaS companies use a variety of tactics to build leads – content marketing, pay-per-click ads, LinkedIn ads, email campaigns, and webinars. Unfortunately, conversion rates are very low.

You have to feed a lot of suspects into the top of the funnel to get a reasonable number to come out at the bottom.FirstPageSage, a B2B SEO agency, published an excellent report in 2021 on B2B SaaS Funnel Conversion Benchmarks. Here is an excerpt:

Different Demand Generation techniques yield different results. In FirstPageSage’s analysis:

- SEO represents website visitors that come to your site as a result of organic (non-paid) content marketing

- PPC represents visitors responding to Pay Per Click ads, like Google Ads

- LinkedIn represents visitors from LinkedIn Ads

- Email represents visitors from email campaigns

- Webinar represents conversions from webinar attendees

If you work for a B2B SaaS company that wanted to grow a product’s revenues by $20 million in a year, you could estimate how many suspects/contacts you would need to feed into the top of the sales funnel to achieve your revenue target.

The sad reality is that even with a combination of tactics, most companies will experience; less than a tenth of one percent final conversion rate.

Marketing teams expend enormous effort planning and executing a portfolio of demand generation campaigns. Sales can be legitimately frustrated when the quantity and quality of leads do not meet their requirements to build a healthy pipeline and closed business.

Understanding Why Sales Wins and Loses Deals is Critical

Given the paltry conversion rates from contemporary demand generation programs, gaining insight into what works and does not work is critical.

Sales leaders and sales reps generally despise ‘inspection’ of their work. CRM and Sales Force Automation solutions track every move a salesperson makes and create a permanent record. This record lets a wide variety of non-sales personnel inspect and criticize sales leaders and sales reps. Yet insight into what has happened and why it has happened is critical to design and execute demand generation programs. Ineffective programs waste money and time.

Win/Loss Analysis or post-decision interviews are a way of addressing this challenge. Win/Loss Analysis is a qualitative research technique to help you understand why you won or lost a particular deal. Interviews with people who participated in the decision-making process are the main focus of Win/Loss Analysis. During the interviews, a series of open-ended questions are asked. The goal is to understand why the prospect/customer acted the way they did. The MoneyWheel can tell you what happened, Win/Loss Analysis helps you understand why it happened.

I’ve conducted dozens of win/loss analysis programs for enterprise software companies. In almost every case the primary reason why a company lost a deal had nothing to do with the salesperson’s abilities or individual performance. Instead, there were multiple factors that involved people from product management, marketing, operations, support, finance, and sales. The intelligence provided from Win/Loss Analysis projects can make a huge difference in driving more qualified leads from Marketing to Sales. If you would like to learn more check out What is Win/Loss Analysis?

Summary

Conflict is almost inevitable between SaaS Marketing and Sales organizations. A lot of conflict arises from the short tenures of Marketing and Sales executives. Marketing and Sales teams are almost congenitally misaligned. By understanding why a sales team wins and loses deals, marketing teams can develop effective demand generation programs to deliver the quantity and quality of leads the sales team need to hit their number.

Also published on Medium.