I work with many pre-seed and seed stage startups. Understanding key metrics is essential to navigating their growth journey. This summary of the 2023 OpenView SaaS Benchmarks Report focuses on seven crucial metrics categories for companies with ARR below $1M and between $1M and $5M. These insights are tailored to provide a clear and actionable overview helping you make informed decisions for your business. In this post, we will talk about:

- Employee Distribution by ARR

- Revenue Per Employee by ARR

- Operating Expenses by Category and ARR Bucket

- Expansion Revenue by ARR

- Gross Dollar Retention by ARR

- Net Dollar Retention by ARR

- Push for Profitability by ARR

- OpenView Study Demographics

- Benchmark Definitions

- Overall Saas Industry Benchmarks

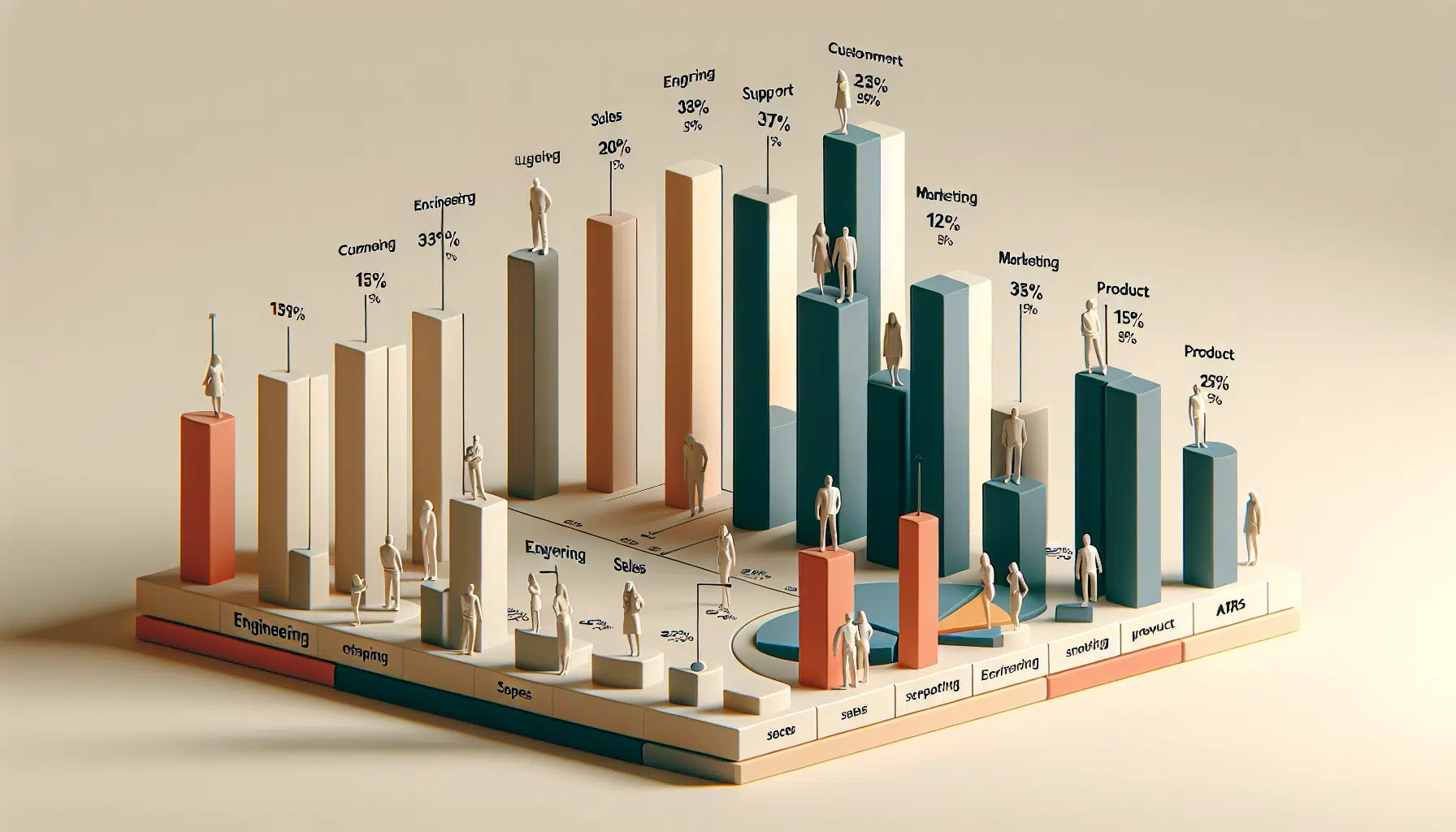

1. Employee Distribution by ARR

Employee distribution varies significantly across different ARR buckets. For companies with ARR below $1M, the median number of employees is 12, while those in the $1M-$5M range typically have 34 employees. Here’s a breakdown of how these employees are typically distributed across different departments:

- Engineering: Consistently the largest department, typically representing 30% of employees.

- Sales: Around 15% for <$1M ARR and 14% for $1M-$5M ARR.

- Customer Support & Services: Approximately 17% for <$1M ARR and 15% for $1M-$5M ARR.

- Marketing: About 9% for <$1M ARR and 7% for $1M-$5M ARR.

- Product: Around 13% for <$1M ARR and 11% for $1M-$5M ARR.

- Other: Varies, but often includes HR, Legal, and IT, making up about 17% for <$1M ARR and 20% for $1M-$5M ARR.

2. Revenue Per Employee by ARR

Revenue per employee is a critical metric for assessing productivity and efficiency. For companies with ARR below $1M, the median revenue per employee is $42K. In the $1M-$5M ARR range, this figure increases to $90K. Top quartile performers in these categories achieve even higher revenue per employee, with $80K for <$1M ARR and $150K for $1M-$5M ARR.

3. Operating Expenses by Category and ARR Bucket

Understanding operating expenses is vital for managing cash flow and profitability. The report categorizes expenses into Sales & Marketing, R&D, Operating Costs, and COGS (Cost of Goods Sold):

- Sales & Marketing: For <$1M ARR, median spend is 27% of ARR; for $1M-$5M ARR, it’s 35%.

- R&D: For <$1M ARR, median spend is 40% of ARR; for $1M-$5M ARR, it’s 40%.

- Operating Costs: For <$1M ARR, it’s 30% of ARR; for $1M-$5M ARR, it’s 28%.

- COGS: For <$1M ARR, it’s 17% of ARR; for $1M-$5M ARR, it’s 20%.

4. Expansion Revenue by ARR

Expansion revenue becomes increasingly important as SaaS companies grow. In early stages (<$1M ARR), 86% of net new ARR comes from new customer acquisition, with only 14% from expansion. For companies in the $1M-$5M ARR range, 26% of net new ARR comes from expansion.

5. Gross Dollar Retention by ARR

Gross dollar retention (GDR) measures the percentage of recurring revenue retained from existing customers, excluding upgrades. Median GDR for companies with ARR below $1M is 84%, while for those with $1M-$5M ARR, it’s 90%. This indicates a solid customer base that remains loyal even as the company scales.

6. Net Dollar Retention by ARR

Net dollar retention (NDR) includes the impact of upsells, expansions, and churn. For companies with ARR below $1M, median NDR is 100%, indicating they retain and expand revenue within their existing customer base effectively. In the $1M-$5M ARR range, median NDR is 99%.

7. Push for Profitability by ARR

As SaaS companies grow, the push for profitability becomes more pronounced. Here’s how the percentages of companies that are break-even or profitable look across the ARR buckets:

- <$1M ARR: 22% are break-even or profitable.

- $1M-$5M ARR: 29% are break-even or profitable.

OpenView Study Demographics

Benchmark Definitions

Overall Saas Industry Benchmarks

Also published on Medium.