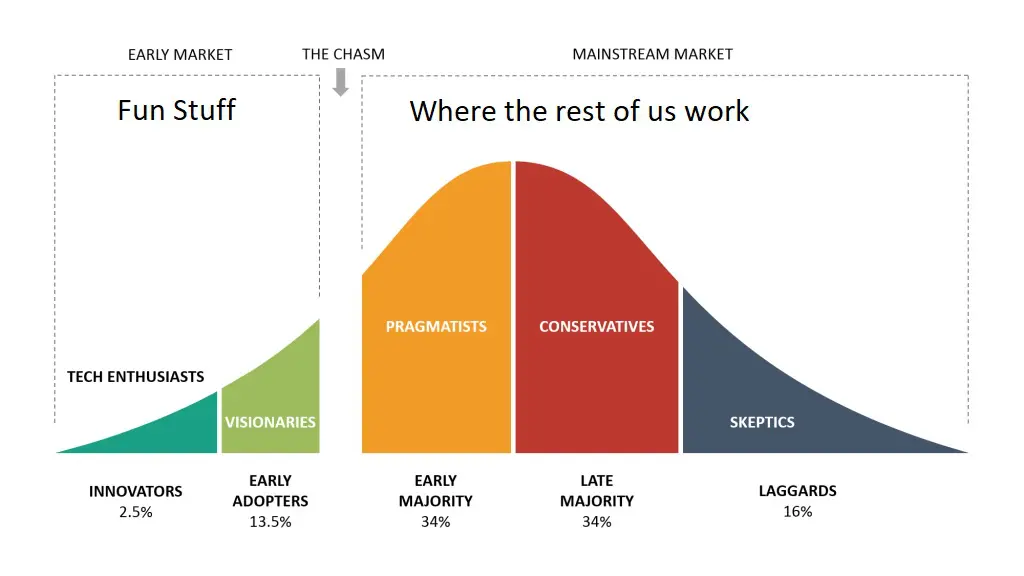

Product management in early stage markets can be a lot of fun. You can apply a lot of modern product management techniques like MVPs, outcome-based roadmapping, etc. The sad reality, however, is that the majority of product managers work on products that are in the latter stages of the technology adoption lifecycle. Having a large, successful product imposes a lot of constraints that early market products don’t face. While many of the principles of modern product management, like those espoused by Lean Startup can be applied to middle aged products, there are other principles that are important.

10 Product Management Principles for Middle Age Products

Middle aged or ‘senior citizen’ products require additional product management strategies that early stage products don’t. While there are many approaches to maximizing the success of middle aged products, here are 10 principles that have withstood the test of time:

1. Maximize Revenue Retention

The first priority for a product manager of a middle aged product is to maximize revenue retention. It costs much less to keep an existing customer happy than acquire a new customer. Some studies have shown it can cost five times as to attract a new customer than to keep an existing one. The real challenge low revenue retention introduces is total revenue growth. Most software companies are valued by their annual revenue growth. If your firm/product has low revenue retention, it creates a ‘hole’ that must be filled before your company can show any annual revenue growth. When your firm is in the startup phase revenues are often in the $5 million to $20 million range. A 90% revenue retention rate translates into $500,000 to $2.0 million ‘hole’ that has to be filled. This is certainly a feasible amount in a fast growing company. A middle aged company, however, might have annual revenues of $50 million to $100 million. The ‘hole’ created by low retention could be $5 to $10 million – a significantly bigger challenge.

The unfortunate reality is that many of the reasons why customers do not renew are self-inflicted. These are decisions made by product management or executive management that do not resonate with existing customers. A middle aged SaaS company did a study of what were the major reasons behind their industry low revenue retention. Consider the following chart:

This is an analysis of the reasons why customers did not renew their subscription for a $70 million SaaS company. The company had experienced a high cancellation rate of customers that had used the solution for more than two years. The company conducted a series of qualitative interviews to learn why customers were cancelling. Here’s what they learned:

Price Increases. The company had not raised its prices in two years. It raised prices by an average of 11.5%. There was no significant new functionality in the product. Management thought it would be a good tactic to help them meet their annual revenue growth target of $14 million. Customers rebelled and since there were competitors that offered similar capabilities at similar prices they left. Customers understand that costs go up over time, but they reject price increases that significantly exceed the rate of inflation.

Packaging Changes. The company changed the mix of optional features in their various pricing plans. Based on an analysis of usage, the company bundled high value features into the next highest price plan. Customers had to spend more to get access to features they valued. Salesforce.com is the master of this strategy, offering fifteen different packages with each package split into multiple editions with varying price points. Check out the full Salesforce.com pricing plans.

Discontinuous Upgrade Pricing. Customers expect pricing plans to be consistent, logical, and fair, especially for upgrades. The more a customer buys, the better the priced should be. One $100M SaaS company decided something different. They offered an entry level package that included a usage credit (10,000 transactions a month and four modules of advanced functionality. Users found that they were often exceeding the monthly usage limit and were hit with overages. After three months of overages they were offered an upgrade package that included 50,000 transactions and access to 10 modules of advanced functionality. Unfortunately, the cost of the upgrade was 8X the entry level package. The users saw little value in the additional modules of advanced functionality. Instead of upgrading, the users took proactive steps to limit their monthly transactions. Many migrated to a competitive solution that had less functionality, but significantly lower transaction costs. Instead of creating new revenue through upgrades, the vendor’s packaging and pricing decisions actually increased customer churn.

Outages. Outages occur in SaaS applications – even Google is not immune to the occasional outage. If your SaaS application has frequent outages it can result in higher than anticipated revenue attrition. This is especially true if your application is mission-critical for your customers.

Subpar Customer Service. Customers expect professional, effective, and timely customer service. If your customers experience long elapsed time to resolve critical issues, they will eventually consider alternate providers, even if the new supplier has higher costs.

The root cause of all these issues is management made a decision that was contrary to the best long term interest of their existing customers. These types of revenue retention issues can be avoided.

2. Gross Margin & Operating Profit Matter

By the time a product reaches middle age it usually has developed a significant revenue stream. Generally companies have multiple products in their portfolio. It is important for product managers to understand their product’s gross margin and operating profit numbers. Historically, product managers have not had a major focus on the financial aspects of their products. They are usually focused on understanding market problems, translating them into user stories, and eventually working them into the backlog. For middle aged products, product managers tend to take on more responsibilities like go to market planning, sales support, resolving customer escalations, etc. Unfortunately, product managers tend to spend little time on the financial aspects of their products. The Pragmatic Institute found that only 22% of product managers spent significant amount of time on the P&L of their products:

Contrary to Ben Hrowitz’s “Good Product Manager/Bad Product Manager” most product managers are not the CEO of their product. They usually have limited access to product line financial information. Yet executives judge a middle aged product’s success or failure by common financial metrics like Gross Margin or Operating profit. As noted in Why Product Managers Should Become Best Friends with Finance Team

Pro Forma is as Good as it Gets

If an enterprise has more than one product line, product managers will most likely have access to only pro forma P&Ls. Most enterprises can track revenue at a product line level, but face significant challenges on the expense side. Some expenses, like commissions and developer headcount specifically associated with a product, are directly tied to a specific product. Many expenses, like customer support, finance, and HR support many products. As a result the finance team must allocate these expenses amongst the various products. There are many ways to perform the allocations, but it is an exercise in pro forma reporting.

DevelopmentCorporate

While product managers do not control how much revenue their products generate or what costs are allocated to it, they should be aware of key financial metrics like revenue, costs of goods sold, operating expenses, depreciation, and amortization. A former employee of mine who had moved into a senior product management position at a major worldwide provider of telecommunication equipment suddenly found himself out of a job when the gross margin of the products he managed fell below 75%. Part of the decline was due to rising headcount costs (health insurance, etc.) and another part was due to a series of goodwill impairments.

3. Dates Are Important

Contemporary product management thinking is that product roadmaps should not contain dates. Instead they should illustrate the sequence of items being implemented. This allows for flexibility and the ability to adjust plans based on testing and feedback. Janna Bastow, the CEO of Prodplan does an excellent job of describing the thinking behind this approach in How to Sell Your Boss on Roadmaps Without Timelines.

A lot of this thinking is associated with products that are in the early stages of the technology adoption life cycle – innovators, early adopters, and early majority. In these stages the evolution of the product is frequent and dynamic. In latter stages, (late majority & laggards) the pace of new features declines dramatically. Bug fixes, environmental currency (O/S, DBMS, Integrations, etc.), and long standing customer feature requests dominate.

In this context, dates are important. Customers, especially of components of mission critical systems, need time to plan and test upgrades or new versions of solutions. This is especially true of SaaS solutions that are tightly integrated with other solutions customers have implemented –both on-premise and SaaS solutions. They need to allocate and schedule resources for testing and validation. Roadmap or release plan dates are critical. Keeping date commitments is critical to maintain customer confidence.

4. Differentiated Customer Service is a Must

Differentiated customer service is a must-have for middle aged products. While a salesperson might talk to a customer five or ten times during a sales cycle, the customer might talk to customer support a hundred or a thousand times during their lifetime with the company. Customer service makes a bigger impact on customer’s perception of your company than any other department.

Unfortunately, not all customers are created equal. By the time a product reaches middle age it can amass a customer base composed of all types of firms. Product managers need to ensure that the most valuable customers receive excellent service. Since all resources have a finite limit, customer service needs to prioritize the most valuable customers and if necessary accept lower service levels for less valuable customers. Consider the following table:

The table breaks down a customer base for one product of a $70 million SaaS company. This is known as tiering analysis. It shows how 44.8% of the customers account for over 90% of the revenue. Conversely it shows that 52% of the customers deliver 5% of the revenue. Clearly support resources should be focused on the top tier customers, and lower service levels for bottom tier customers would not have a significant financial impact on the firm.

Customer Service is Not a Solution to Your EBITDA Problems

Many middle aged software firms are owned by private equity firms. These companies usually have annual EBITDA, profit, and cash flow targets. Many times these investors use debt to finance these acquisition of such firms. The debt often has specific covenants regarding EBITDA. When annual revenue falls short, so does EBITDA. Management will often look to reduce customer support expenses to boost EBITDA. The revenue impact associated with customer support reductions (increased attrition) is slow. Eventually customer support reductions reach a tipping point where increased attrition and impact on new revenues far outweighs the short term profit benefit. While customer support expense reductions can bring almost immediate profit benefits, the recovery time from excessive cuts is significantly longer.

5. Product Line Extensions / Add Ons are a Must

One of the easiest ways to grow product line revenues is to develop and launch product line extensions / add on products. You already have a captive customer base that you should know very well. This significantly reduces the risks associated with a new product launch. It is important, however, that any product extension or add on delivers true incremental value to the customer. Rebundling existing features and slapping a price tag onto them is a recipe for customer anger and attrition.

Add on products provide a mechanism to respond to industry changes or technology innovations. For example the advent of data science post 2008 led many firms to introduce advanced analytics capabilities as add on products. When Salesforce.com acquired Tableau in 2019 they introduced over 30 add on modules to the core Saleforce.com.

In 1998 I worked for a firm that offered Computer Aided Software Engineering tools — essentially code generation tools for mainframe, UNIX, & Windows applications. In the late 1990s the Internet was exploding and the demand for web applications was tremendous. Our products were geared to generate applications for mainframe CICS, Unix VT100, or Windows fat client applications. We were missing out on the Internet revolution. One of our senior research fellows came up with a product idea – a web service proxy generator. This tool allowed a customer to generate a web service interface to any application they had already created using our tools. This enabled them to Internet enable their entire application portfolio quickly and easily. The add-on sold for $100,000, with an 18% annual maintenance fee. In two years we sold it to 523 of our 923 enterprise customers. It enabled us to join the Internet revolution while leveraging our significant existing customer base.

6. Non-Functional Requirements Are Important

Product managers are primarily concerned with functional requirements. Product managers focus on “what” a product should do. These are generally known as functional requirements. Functional requirements apply to the specific behaviors of a system, whereas non-functional requirements form measurable criteria that can be used to gauge the success of an overall system, solution, or product. Functional requirements describe what the solution should do. Non-functional requirements describe how it should be. The following chart describes the common categories of non-functional requirements:

Product managers and product owners face the difficult decision of to balance the priority of functional requirements, non-functional requirements, and technical debt. In middle aged products investments in non-functional requirements can often lead to a reduction of Cost of Goods Sold (COGs) and increased profits.

7. SOC 2/3 is a Must Have

Statement of Capabilities Type II (SOC2) was introduced in 2011. By now customers expect that a provider of SaaS solutions will have successfully completed a SOC 2 audit and have the audit report available for review. For customers that are public companies SOC 2 is almost mandatory so they can comply with Sarbanes Oxley regulations.

Many prospective customers will not consider exclude a vendor that does not have SOC 2. The sales excuse of “We’re working on our audit right now” doesn’t fly 10 years after SOC was introduced. It is generally acknowledged that SOC audits can help significantly improve a SaaS firms operations, productivity, and profitability.

8. Eliminate SPOFs

SPOFs or Single Points of Failure are the bane of SaaS companies. Many outages can be traced back to a single point of failure in an application. Customers expect their applications to be available. Outages in mission critical systems are unacceptable and can lead to SLA penalties or even financial repercussions for the customer.

Effective organizations always conduct formal root cause analysis investigations after major outages. These investigations can help uncover and document the impact of SPOFs. SPOFs are not always related to hardware, software, or connectivity –humans can be SPOFs as well. In one case, a private equity backed SaaS firm utilized Tandem Non-Stop servers. These servers were highly fault tolerant and almost the gold standard of high availability. This firm had a 72 hour outage due problems with these servers. One f the consequences is that the outage resulted in the shutdown of production for several Japanese auto assembly plants in the USA. The root cause of the outage was human based. The SaaS company had let its two critical Tandem systems programmers leave the company over a dispute regarding compensation. They brought in some contractors, but they were not as skilled as the original system programmers. As the outage progressed and the financial impact grew, the company was forced to hire the departed system programmers as consultants –for a fee of $75,000. When the system programmers arrived it took them less than 30 minutes to diagnose and fix the issue. There’s a saying ”expensive lessons are the ones you learn the best.” The company’s SPOF elimination program started the next day.

9. Analyst Perceptions Count

In 2021 the buyer’s journey continues to evolve. A commonly cited statistic is “67% of the buyer’s journey is completed digitally before ever contacting sales” is one of the worst Internet marketing myths out there. The stat is attributed to Sirius Decisions, a research, sales and marketing consultancy that originally published it in 2013. Sirius Decisions later debunked the myth at one of their conferences in 2015. The data for the 2013 pronouncement came from a joint study by CEB Marketing Leadership Council and Google in 2011 and updated in 2013. Here’s a link to the 2013 report. Gartner has pointed out that the buyer’s journey is a mess:

In spite of this complexity, Industry Analysts like Garter, Forrester, IDC, and Ovum still play an important role. Many enterprise companies will not short list a vendor unless they are in a Gartner Group Magic Quadrant. While there have been occasional ‘pay-to-play’ allegations against Gartner and other analyst firms, none have ever been sustained.

It only makes sense for product managers to build positive relationships with industry analysts. Positive reviews by analysts can only help in sales cycles and analysts can often serve as valuable sources of referrals.

It is important to note that analysts are not infallible. One company I was involved in, which lived in the Laggard stage of the TALC, retained an analyst to help develop a product expansion strategy. The analyst convinced them to build a between the firewall secure mass file transfer solution. The company invested significant money in development, marketing, and a new inside sales team. Unfortunately a competitor emerged – Dropbox. Dropbox raised $1.7 billion in VC funding and simply crushed any competition. My company ended up only selling two subscriptions for their product. One of my first actions as COO was to cancel it.

10. Site Visits Matter

As we enter the post-Covid era the chance for product managers to visit customers will increase. For middle age products, site visits provide a tremendous opportunity for product mangers to learn firsthand how their products are being used and what can be done to improve them. By meeting directly with customers product managers can get feedback without it first being filtered through the biases of a salesperson. Visits can strengthen long-term relationships much better than Zoom calls.

Summary

Products that are in the late majority/laggard phases of the technology adoption lifecycle have additional challenges that startup products do not face. While startup product management can be fun and exciting, product management for products in the latter stages of early majority, late majority, and even laggards are where the money is at.

Also published on Medium.

I counted and found only 9 principles – the one about the important dates is missing 🙂

Plus the numbering is a bit eradical…