Convincing an enterprise to buy your SaaS solution is a hard thing. Product managers are responsible for understanding market problems and translating the problems into stories that drive the creation of backlog items. Product managers help prioritize the backlog items so that the most impactful items are worked on first. This is an ongoing process as a product evolves. Part of the challenge product managers face is explaining the benefits of their evolving products. For startup and early adopter products, it is hard. Once a market evolves to the Early Majority and Late Majority stage it becomes easier. Should product managers of Late Majority products be able to show the quantitative benefits of their products?

Late Majority Product Management is Tough

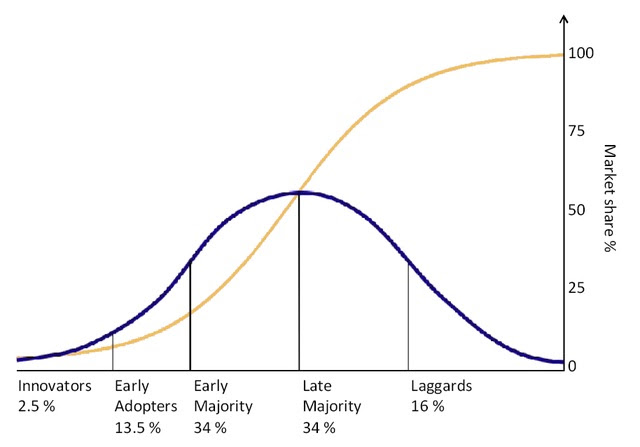

Products in a market that has reached the Late Majority require different product management skills than those faced by early markets. In early markets (visionary, early adopters, and early majority) there is not a consensus yet regarding key requirements. Solutions are often tackling market problems that are not well understood. Some innovations have to be proven by early adopters before the much larger market will embrace them..

While there is a lot of product management guidance for startups and early market products, there is little for Late Majority and Laggard product managers. By the time Late Majority rolls around the market has been formed, the market problems are well understood, and there are multiple vendors providing solutions.

A clear indicator that a market has reached the Late Majority is Requests for Proposals (RFPs). RFPs are used by large enterprise buyers to evaluate and select vendors. The market problems are understood well enough that they can be reduced to a set of requirements. Multiple vendors’ solutions can be evaluated on how well they meet the requirements, and a winner can be selected. Being able to describe the quantitative benefits of a particular solution and back them up with credible evidence is a key part of winning RFP competitions.

Do Late Majority Product Managers Need to Show Quantitative Benefits?

Surprisingly, the answer is No.

Recently I helped a B2B software company select a new CRM solution. They had been using a legacy on-premise Siebel CRM solution that their private equity owners had imposed on them years ago. My client, politely put, was a Late Majority buyer. They had about $75 million a year in revenues and operated mainly in the U.S. and Western Europe. They wanted to see proof of how a solution would benefit them based on actual experience before investing a lot of resources in evaluating a solution.

CRM is definitely in the Late Majority stage of the technology adoption life cycle. CRM, in one form or another, has been around since the 1940s. As noted in Wikipedia:

“One of the best-known precursors of the modern-day CRM is the Farley File. Developed by Franklin Roosevelt’s campaign manager, James Farley, the Farley File was a comprehensive set of records detailing political and personal facts on people FDR and Farley met or were supposed to meet. Using it, people that FDR met were impressed by his “recall” of facts about their family and what they were doing professionally and politically.[6] In 1982, Kate and Robert D. Kestenbaum introduced the concept of database marketing, namely applying statistical methods to analyze and gather customer data.[citation needed] By 1986, Pat Sullivan and Mike Muhney released a customer evaluation system called ACT! based on the principle of digital Rolodex, which offered a contact management service for the first time.

The trend was followed by numerous companies and independent developers trying to maximize lead potential, including Tom Siebel of Siebel Systems, who designed the first CRM product, Siebel Customer Relationship Management, in 1993.[7] In order to compete with these new and quickly growing stand-alone CRM solutions, the established enterprise resource planning (ERP) software companies like Oracle, SAP,[8] Peoplesoft (an Oracle subsidiary as of 2005)[9] and Navision[10] started extending their sales, distribution and customer service capabilities with embedded CRM modules. This included embedding sales force automation or extended customer service (e.g. inquiry, activity management) as CRM features in their ERP.”

As a part of my client’s process, we set about to qualify potential vendors to be included in the RFP. We sent the following inquiry to the top 15 vendors listed in the CRM Leaders Quadrant of a popular user review site:

A client of mine, a $75 million annual revenue B2B software firm, has started a project to replace their legacy on-premise Siebel system. Your product has been identified as a potential solution.

My client is a classic ‘Late Majority’ buyer. They want to see proof of how well a solution has worked for similar companies in their industry. Can you share some information that describes the quantitative benefits of your solution? They are especially interested in quantitative benefits in comparison to Salesforce and SAP.

We used either the vendor’s website chat function or sales email to make the inquiry. Being a B2B software company, my client wanted to qualify potential vendors before they had to invest the time to be qualified by the vendor’s sales team.

The results were interesting:

We were a little surprised that only 40% of the vendors could provide some quantitative benefits in our first interactions with them. We were not looking for peer-reviewed, statistically significant analyses. We were hoping for multiple customer stories, some industry surveys they had done, and maybe a few ROI calculators. It is not surprising that the largest vendors were able to provide quantitative benefits — they have the resources and customer bases to do so. Vendors with under $100 million in revenue struggled.

These vendors all had been in business for quite some time – the average age was 13.5 years. Yet almost all of them led with detailed feature/function descriptions. Generally, we followed up and asked again for quantitative benefits. The results were disappointing. Here are a few snippets from our email exchanges:

While it was disappointing that only 40% of the vendors could directly answer my question, it was not surprising. Sales Development Reps work off of scripts and playbooks. SDRs work hard and have a tough job. Most are incented on the number of meetings booked or qualified sales opportunities they created. A consistent theme in all of my interactions was the SDR’s request to ‘jump on the phone for a quick call’ or to arrange a demo. One SDR said he could get me ‘with an Executive within the hour.’ I’ve been a senior executive for a few SaaS companies and I have never jumped on a call with an unqualified prospect in less than an hour. I suspect that this vendor, which has close to 1,000 employees, was teeing me up to talk to a sales guy.

Why Late Majority Product Managers Need to be Able to Talk About Quantitative Benefits

Buyers in Late Majority markets behave differently than those in Visionary, Early Adopter, and Early Majority markets. As pointed out by Lars de Bruin:

The Late Majority as a group is about as big as the Early Majority (34% of the total population). They share all the concerns of the Early Majority plus one major additional one: they believe far more in tradition than in progress. Whereas people in the Early Majority are comfortable with their ability to handle a new technological product, should they finally decide to purchase it, members of the Late Majority are not. As a result, these Conservatives prefer to wait until something has become an established standard and invest only at the end of a technology life cycle. And even then they want see lots of support and tend to buy from large, well-established companies only. Being the market leader is therefore an important prerequisite in order to win over the Late Majority.

Crossing the Chasm in the Technology Adoption Life Cycle

Late Majority buyers want to see proof that a solution works and delivers value. Such buyers are risk-averse — they would rather wait until they see the proof than risk implementing something that does not deliver value.

How Can Late Majority Product Managers Deliver Credible Quantifiable Benefits?

As shown by our little experiment with SaaS CRM vendors, it is not unusual for established SaaS companies to struggle with quantifiable benefits. Most organizations can benefit from a periodic refresh of their messaging, value equations, and proof points.

A value equation is the customer perceived benefits minus the cost of the solution. A proof point is an example that offers irrefutable evidence of the quality, importance, or uniqueness of something. Proof points need to be accurate, convincing, and believable.

Value equations should be structured like this:

<Action Verb> + <Value Statement> + <Quantifiable/Qualifiable Benefit>

Examples for a salesforce automation provider would be:

- Increase forecast accuracy by 48%

- increase lead rate conversion by 43%

- Increase win rate by 37%

An article entitled Why Do Product Manager Value Equations Suck? Lays out six tactics that product managers can use to build credible value equations and proof points for Late Majority markets:

1. Update Your Product Messaging Platform

A messaging platform organizes all of the key messages for your product. Consider the following diagram:

You should prepare a document like this for each of your buyer personas. If it takes you more than 15 minutes to build this for one persona, then you might have a problem.

2. Build an ROI/Benefit Calculator

If you don’t have irrefutable proof points yet, add an ROI/Benefit calculator to your website. These types of calculators are extremely helpful sales tools. Here are some example calculators for SaaS marketing automation providers:

- SalesForce: https://www.salesforce.com/form/app-cloud/roi-calc.jsp

- Hubspot: https://www.hubspot.com/roi-calculato r

- Act-On: https://www.act-on.com/learn/free-tools/economic-impact-calculator/

- Pardot: http://www.pardot.com/roi-calculator

- InfusionSoft: http://www.pardot.com/roi-calculator

- SharpSpring: https://sharpspring.com/alternatives /

Capture and retain the information prospects enter into the calculator. It will give you insights into how you can sharpen your value equations and proof points.

3. Refresh Your Analyst Relationships

While TrustRadius goes out of its way to denigrate industry analysts like Gartner and Forrester. Large-scale enterprises still value analyst firm opinions. Consider this Gartner Magic Quadrant for CRM lead generation solutions:

Getting categorized as anything but a leader can be problematic. Many enterprises will not include a vendor in an RFP if they are not included in a Gartner MQ.

Many people complain that there is a ‘Pay-to-Play’ issue with industry analysts like Gartner. I have worked with Gartner, Forrester, IDC, Ovum among others for over 25 years. While I have spent a fair amount of money on their services, I never received any preferential treatment.

It is possible to improve your relationship with analysts. You need to understand who is responsible for covering your market and what their priorities are. You need to feed them fact-based insights and proof points about your solution. I did that for one company I worked for. They had been pegged in the niche category of their Magic Quadrant for years. Over ht course of 12 months, I worked with the main analyst covering our space. I secured promotion from the Niche Quadrant to the Leaders Quadrant, without spending any money on analyst services or consulting. The number of RFPs that we were invited to participate in skyrocketed after that promotion.

4. Refresh & Expand Your Customer Stories

One reason Salesforcce.com is successful is that they provide over 300 customer success stories on their website. You should be constantly writing about your customers’ success. You should also actively encourage your customers to post their reviews on user review sites like Capterra, G2, and Software Advice. A huge red flag for prospective customers is when you have good success stories on your website, but those same stories cannot be found on the user review sites.

Jon Gatrell wrote a great article in 2009 “Marketing Statistics Are Hard . . . Sometimes It’s Just Easier to Make Them Up”

If your company is in this kind of situation I have a plan that you could execute on your own to build and leverage credible proof points for your solutions.

“The core of this project is helping customers document and then promote their own success using your solutions. Everyone likes to have their horn tooted. By helping your key users or champions demonstrate the wisdom of their decision to acquire and deploy your solution you can create a win-win scenario. For lack of a better term I’ll call this a ‘Customer Success Program’. The goal of the program is to get 6 to 12 customers to participate in a study to document the business impact your product or service has had on their organization. The deliverables of the program will be individual case studies and a microsite or blog. While the customers who participate in the program can distribute the case study internally, as a vendor you will anonymize their identity in any external presentation of the information and only use summary information. This approach has two benefits. First, by creating a solid, fact-based analysis of the customer’s success you enable the key users and champions to tout their success inside of their company. By anonymizing their identities and using only summary information externally you can typically get over any of the typical hurdles customers have with public endorsements of your products and solutions.

Your real goal in this project is to develop 3 to 5 rock-solid proof points that you can make about your products and solutions. To make this work you’ll probably need to approach a pool of 30 to 40 customers, split up into three to four verticals. If you can get 6 to 10 customers to participate, you will have hit a home run. Also, you’ll need to identify inside of your organization who has the best personal relationship with the target customers and users – sales, professional services, customer services, etc. You will need to develop a basic survey instrument – situation assessment, business problem, decision-making criteria, hard and soft benefit categories, risks, and risk mitigation strategies. Leveraging your firm’s best personal contacts, ask for a brief teleconference with your targeted users/champions to explain the program and ask for participation. Emphasize that this is a fact-finding mission on how effective your product or service has been and that you are interested in learning how you can improve your offerings even further. Stress the anonymity in the use of any results from a marketing and sales perspective and emphasize the benefits of having a documented case study for internal consumption in the customer organization.

You will learn a lot of things in the execution of this kind of project. First, you will find out who inside of your company really does have good relationships with key people at your customer organizations. Second, you’ll learn that a lot of people are passionate about your technology and more than happy to share their experiences. Third, it is inevitable that you will learn some things about your product, services, and company that you did not want to hear but definitely need to be fixed. Finally, you will be able to harvest real fact-based information to support the proof points you need to effectively market and sell your solutions.”

Marketing Statistics Are Hard . . . Sometimes It’s Just Easier to Make Them Up”

Summary

Late Majority Markets are hard, but in reality, over 50% of the lifetime revenue a product generates occurs after the early majority phase of the technology adoption life cycle. To compete effectively, product managers need to be able to crisply describe the quantifiable benefits of their solution.

Also published on Medium.